In January 2019 the company announced higher pricing for each of their plans, which represented the largest price increase in the company’s history according to Variety. They still had room to try their luck again. The resounding success of their 2017 pricing increase gave Netflix the conviction that they had not yet reached a ceiling on price, the point at which price becomes an impediment to subscriber growth.

But if it worked once, why not try again? It would seem prudent to avoid rocking the boat knowing that the competitive landscape was about to get tougher as consumers would now have the choice of new streaming services from Apple, Disney, CBS, YouTube and many others. Netflix could have taken their pricing windfall and called it a day. You can guess what happened to Netflix’s stock price.

(Sidenote: Even very small pricing increases can have an outsized impact on a company’s profitability. Operating income jumped to $245M, up from $154M the previous year. With more subscribers, and with all subscribers now paying 10% more on average, Netflix saw a massive increase in profits. When asked about the impact of the price increase, CEO Reed Hastings told analysts, “We saw very little effect on sign ups and growth and thus, the really strong results.” #Humblebrag. Both new and existing customers happily swallowed the price increase, which lifted Netflix’s revenue by 35% (faster than their 25% growth in average paid streaming memberships). In fact, Netflix added 2 million new streaming subscribers in the US and 6.4 million overseas, 33% more than what Wall Street analysts had forecast. Subscriber growth was not hurt by the pricing increase whatsoever. On Monday, January 22, Netflix announced the results in their Q4 2017 earnings.īy all measures, colossal success. Given the company’s fraught history with pricing, I could not wait to hear how the 2017 pricing changes are impacting Netflix’s bottom line went. With this new change, Netflix announced that existing customers would be automatically migrated into new plans – a move in stark contrast to a 2014 pricing change that grandfathered in existing customers, allowing them to keep lower prices for two years before being migrated to the newer, more expensive plans.

#Netflix pricing model plus#

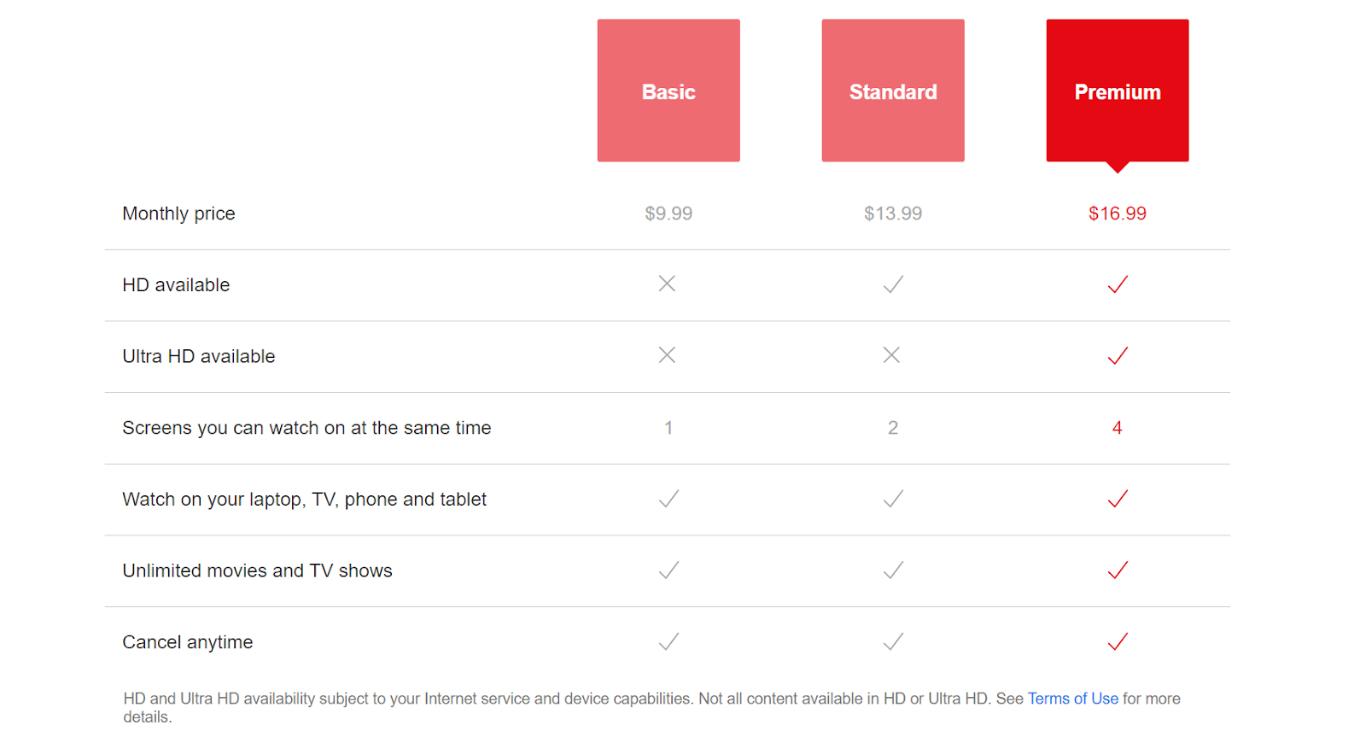

This change crossed a critical threshold in the minds of consumers and create a sizable gap in price between Netflix and Hulu Plus (which rings in at $7.99 a month). They raised the price of their core Standard plan from $9.99 per month to $10.99 per month. In October of 2017, Netflix announced another pricing change. All of this uncertainty didn’t instill much confidence…įast forward to present day. And, if they had run focus groups, he wasn’t sure what those focus groups had said. When asked about the 2011 price change, Netflix’s CEO Reed Hastings said he wasn’t sure if the company had run customer focus groups before announcing the new plans. In the chart below, you can see the painful progression (courtesy of Yahoo! Finance). Over the course of four months, Netflix’s stock price dropped by almost 80% compared to July 2011. Their stock price plummeted immediately following their Q3 2011 earnings release. Netflix lost a whopping 800,000 subscribers in Q3 2011. The public reaction was staggeringly negative. And they rebranded their DVD-by-mail business to Qwikster. They unbundled streaming plans from the traditional DVD-by-mail business, increasing the price of the combined offering from $10 a month to $16 a month. Back in 2011, Netflix restructured their pricing in a big way. Editor’s Note: This article was first published on January 25, 2018.

0 kommentar(er)

0 kommentar(er)